Captive Insurance Practice Recently Added by GF&M

The addition of the practice of Captive Insurance expands the services that Gordon, Fournaris & Mammarella, P.A. offers its' clients. A captive insurance company is formed to insure the risks of its owner, affiliated businesses, or a group of companies. Captives can be used to minimize insurance costs and control risk. If a captive is properly formed and operated as an insurance company, the premiums paid to the captive are a deductible business for the insured.

More about Captive Insurance »

What is a Captive?

A captive insurance company is an insurance company formed to insure the risks of its owner, affiliated businesses, or a group of companies. Captives have been recognized as valuable risk management tools, allowing businesses to effectively manage corporate risks of all kinds. Due to the favored tax treatment of smaller captives under Internal Revenue Code Section 831(b), a captive can offer certain tax and estate planning benefits to its owners.

Insuring Through a Captive

Captives can be used to minimize insurance costs and control risk. They can write coverage for risks that are not available, or not affordable, in the commercial market (see attached list of potential coverages). As part of a comprehensive risk management program, creating a captive can allow the parent to supplement or extend its existing commercial policies and to customize coverage to meet its unique needs. Creating a captive may also help a business lower its commercial premiums by allowing the business to raise its deductibles. In addition, as an insurance company, the captive can buy reinsurance on the wholesale market at rates significantly lower than those available to the operating business.

Because favorable claims experience results in underwriting profit for the captive, a captive provides the parent with incentives for loss control and allows the enterprise to retain premium dollars. A captive also provides the business with greater control over the claims process.

Potential Income Tax Benefits

If a captive is properly formed and operated as an insurance company, the premiums paid to the captive are a deductible business expense for the insured. Under Internal Revenue Code Section 831(b), a captive that receives less than $1.2 million in annual premium does not treat the premium as taxable income – the captive is taxed only on its investment income. This means that by establishing a captive qualifying under Section 831(b), a risk that is currently self-insured can be transferred off a business’s balance sheet in a tax efficient manner.

Estate Planning Opportunities

A captive can provide significant estate planning and wealth transfer opportunities. By forming a captive that is owned by a trust for the benefit of the business owner’s family, wealth can be transferred from the business to the family without exposure to gift, estate or generation-skipping transfer taxes. Asset protection benefits also make forming a captive an attractive and powerful estate planning strategy.

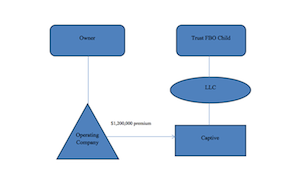

Estate Planning with a Captive

In a popular captive structure, a trust is established for the benefit of the business owner’s child. The trust takes an ownership interest in the captive through ownership of a single member limited liability company, which in turn owns the captive. On an annual basis, the operating company pays up to $1.2 million in premium to the captive. The trust, through its ownership in the LLC, receives the economic benefit of the underwriting profits and investment income. By serving as manager of the LLC, the business owner can exercise decision-making authority over the captive, selecting the risks to be insured and directing the investment of premium dollars.

Captive Insurance Coverages

Small captives often cover “low frequency/high severity” risks – the kind of risks that have disastrous consequence to the insureds. Coverage for these risks is often difficult to obtain in the commercial market, and when it is available, the cost can be prohibitive. Below is a list of commonly utilized coverages in small captives. Insuring risks such as the ones on the list can help the insured fill gaps in their existing property and casualty and liability coverage caused by exclusions, deductibles, and market conditions.

Commonly Utilized Coverages in Small Captives

|

Accounts Receivable |

|

Loss of Key Contract |

|

Administrative Actions |

|

Loss of Franchise |

|

Adverse Audit - Medicare |

|

Loss of Key Customer |

|

Billing Errors & Omissions |

|

Loss of Key Employee |

|

Breach/Release of Data |

|

Loss of Key Supplier |

|

Business Interruption |

|

Loss of License/Certification |

|

Computer System Failure |

|

Loss of Referrals |

|

Contingent Business Interruption |

|

Loss of Rental Income |

|

Continuing Resolution |

|

Mechanical Breakdown |

|

Contract Penalty |

|

Medicare/Medicaid Reimbursement |

|

Crisis and Public Relations Management |

|

Non-qualified Plan Administration Error |

|

Deductible Reimbursement |

|

Political Risk |

|

Difference in Conditions |

|

Pollution Liability |

|

Directors and Officers |

|

Product Recall Expense |

|

Eminent Domain |

|

Product Warranty |

|

Errors & Omissions |

|

Property Difference in Conditions |

|

FAA Fines |

|

Reputational Risk |

|

HIPAA Violations |

|

Sexual Harassment/Discrimination Defense |

|

Intellectual Property Infringement |

|

Supply Chain Interruption |

|

Judicial/Administrative Delay |

|

Transit Risk |

|

Legal Defense Reimbursement |

|

Union Organization |

|

Legislative and Regulatory Changes |

|

Workplace Violence |